Shipping Stocks Plummet Amid Market Volatility

The resumption of U.S. port operations following recent strikes has done little to calm market fears, with major European shipping companies seeing significant stock declines. On October 4, Maersk's shares dropped by 8.6% on the Copenhagen stock exchange, while Hapag-Lloyd's fell by 12.8% on the Frankfurt stock exchange. This sharp decrease reflects growing concerns about the long-term impact of labor strikes on global supply chains. The market volatility highlights the fragility of the shipping and logistics industries in the face of systemic challenges.

Market Response and Increased Cost Pressures

The Wall Street Journal reported that the additional costs arising from wage increases would be distributed between shipping companies and cargo owners, intensifying cost pressures across the shipping industry. Although the strike lasted only three days, the backlog of cargo will extend its effects for weeks, leading to higher demand for capacity and escalating shipping rates.

Fearnley Securities predicts that global fleet capacity will grow by 2.5% in Q4 2023, expanding further to 6.2% by 2025. This capacity increase could drive down freight rates in the medium term, but short-term capacity constraints may continue to support elevated rates throughout the final quarter of 2023.

The stock declines were not limited to Maersk and Hapag-Lloyd. Other shipping firms, including MPC Container Ships and Asian players like Evergreen, also experienced stock drops of around 9% and 10%, respectively. These market reactions underscore widespread anxiety about the vulnerability of global supply chains to systemic disruptions, with uncertainties about the future adding to the apprehension.

U.S. CBP Tightens Import Clearance Rules

On October 7, the U.S. Customs and Border Protection (CBP) will begin enforcing stricter declaration requirements for air freight imports. These new rules mandate detailed product descriptions, including six-digit Harmonized Tariff Schedule (HTS) codes, from all carriers and related ACAS (Air Cargo Advance Screening) data submitters. This is part of CBP’s effort to enhance transparency and accuracy in the import clearance process, addressing the complexities of modern cross-border shipping.

Declaration Requirements and Non-Compliance Risks

Before the policy goes into full effect, CBP initiated a warning phase, sending daily emails to ACAS contacts identifying non-compliant descriptions, such as "gifts," "accessories," "daily necessities," and "parts." Such vague descriptions will be rejected after October 7, resulting in the error code "MISSING_CARGO_DESC." This could lead to delays or outright rejection of cargo at the border.

CBP’s guidelines emphasize the importance of specific and detailed descriptions, barring the use of brand names or ambiguous entries consisting solely of numbers or symbols. Non-compliant declarations will need to be immediately corrected to avoid further clearance issues.

Reform of the $800 Tax-Free Policy

Additionally, in response to allegations of "abuse" of the $800 tax-free small package policy by Chinese cross-border e-commerce platforms, the U.S. government plans to introduce several new regulations by the end of 2024, including:

Eliminating the small tax exemption policy for all products subject to Section 301, Section 201, and Section 232 tariffs.

Requiring detailed supplementary data for tax-free small packages, including a 10-digit HTSUS number and personal information of the exemption applicant.

Implementing final rules that mandate consumer goods importers to electronically submit compliance certificates to CBP and the Consumer Product Safety Commission upon entry, covering all goods, including tax-free small packages.

The U.S. government is also urging Congress to pass comprehensive small package tax exemption reform legislation to ensure stricter regulation of small package imports.

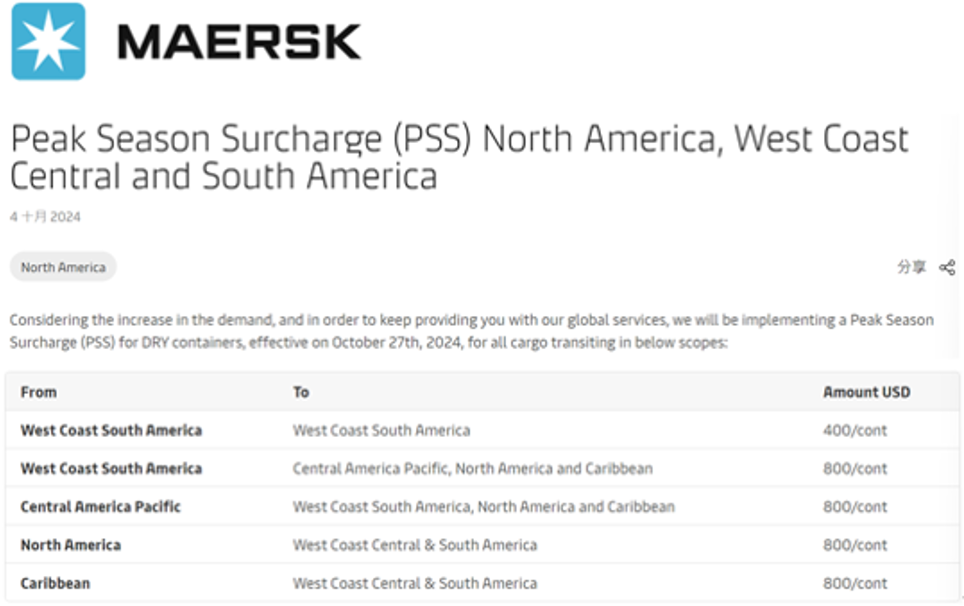

Maersk Implements PSS Fee

According to a notice on Maersk's official website dated October 27, in light of increased market demand, Maersk has announced the implementation of a Peak Season Surcharge (PSS) for certain transshipment cargo in dry containers, with specific charges as follows:

From South America’s West Coast to Central America, North America, and the Caribbean: $800 per dry container.

From Central America to South America’s West Coast, North America, and the Caribbean: $800 per dry container.

From South America’s West Coast to South America’s West Coast: $400 per dry container.

Background and Impact

This fee reflects Maersk's cost adjustment strategy in response to specific peak market demands. With the arrival of the transport peak, this surcharge will help Maersk maintain efficient services during the peak season while offsetting some operational costs. Maersk stated that such surcharges will also assist shipping companies in reallocating resources and optimizing services when market demand surges, but they may also lead to increased cost pressures throughout the supply chain.

How Wakool Transport Can Assist

Reducing Clearance Risks and Optimizing Declaration Processes:

Wakool Transport has expertise in customs clearance and can assist clients in meeting CBP's new regulatory requirements, ensuring that declarations comply with standards and avoiding delays due to unclear descriptions or incorrect HTS codes.

Our customs and compliance services can provide real-time HTS code matching and cargo description checks, helping clients enhance clearance efficiency and reduce the risk of penalties.

Optimizing Supply Chain to Address Additional Costs and Freight Increases:

In response to rising surcharges from shipping companies, Wakool Transport can help businesses reduce transport costs through flexible shipping solutions and a global logistics network, providing diversified transportation methods (such as ocean, air, and rail transport) to adapt to demand changes.

With multiple owned warehousing facilities, Wakool can offer temporary storage solutions, allowing businesses to operate flexibly during peak seasons and when surcharge adjustments occur, minimizing cost pressures from rising fees.

Flexibly Addressing Peak Transport Demands:

Wakool Transport can assist businesses in reallocating resources during peak seasons, rapidly processing large volumes of goods to ensure smooth cargo flow. Additionally, Wakool's intelligent logistics system provides real-time tracking capabilities to help businesses address port congestion and transport delays while maintaining efficient supply chain management.

Responding to Adjustments in Tax-Free Policies:

Wakool's logistics consulting team can assist cross-border e-commerce businesses in navigating U.S. reforms regarding the $800 tax-free small package policy, ensuring compliant cargo entry. Furthermore, Wakool can provide accurate customs and data support services to help businesses adapt to new regulations and data requirements.

Conclusion

As the global shipping industry faces heightened scrutiny, surcharges, and evolving regulatory frameworks, Wakool Transport remains a trusted partner in navigating these challenges. Our comprehensive solutions—from customs compliance to peak season management—help businesses maintain operational stability, minimize costs, and ensure smooth logistics in an increasingly complex market environment.

Comments